Hinkle, Richter & Rhine, LLP: A professional tax and accounting

Lesson 5 Allowable & Disallowable in Taxation-1-1.pdf - Allowable

eCFR :: 17 CFR Part 39 -- Derivatives Clearing Organizations

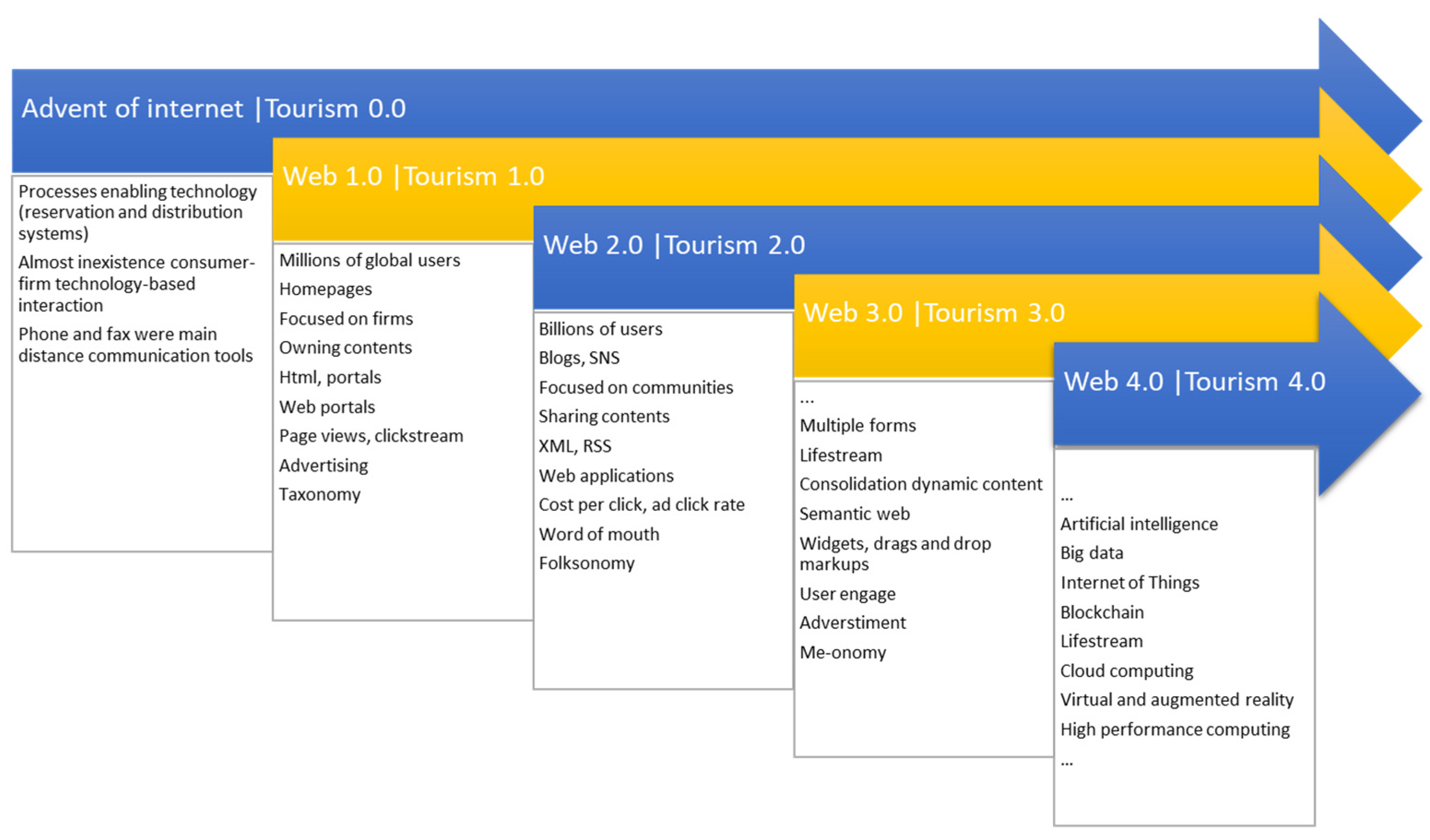

Sustainability Free Full-Text Tourism and COVID-19: The Show

Hinkle, Richter & Rhine, LLP: A professional tax and accounting

OBI Dashboard: Revenue and Fund Management (RFM)

TaxNewsFlash - United States - KPMG United States

IBEX Limited SEC Filing

SEC Filing Hexion

USC02] Appendix

3 Secrets to Proving Self Employment Income - Talkov Law

Recent State and Local Tax Developments

Tags:

archive